CIBIL Login Guide: Access Your Credit Information in Minutes

In today’s fast-paced financial environment, maintaining a healthy credit score is crucial for individuals and businesses alike. Whether you are applying for a personal loan, a credit card, or seeking financial stability for your business, understanding your credit score’s intricacies is essential. One of the most trusted names in credit information is Credit Information Bureau (India) Limited, or CIBIL. Navigating the CIBIL login process effectively ensures you have access to your credit information promptly, helping you make informed financial decisions. This article will serve as your comprehensive CIBIL login guide, providing you with insights on how to access your credit information within minutes.

Understanding CIBIL and Its Importance

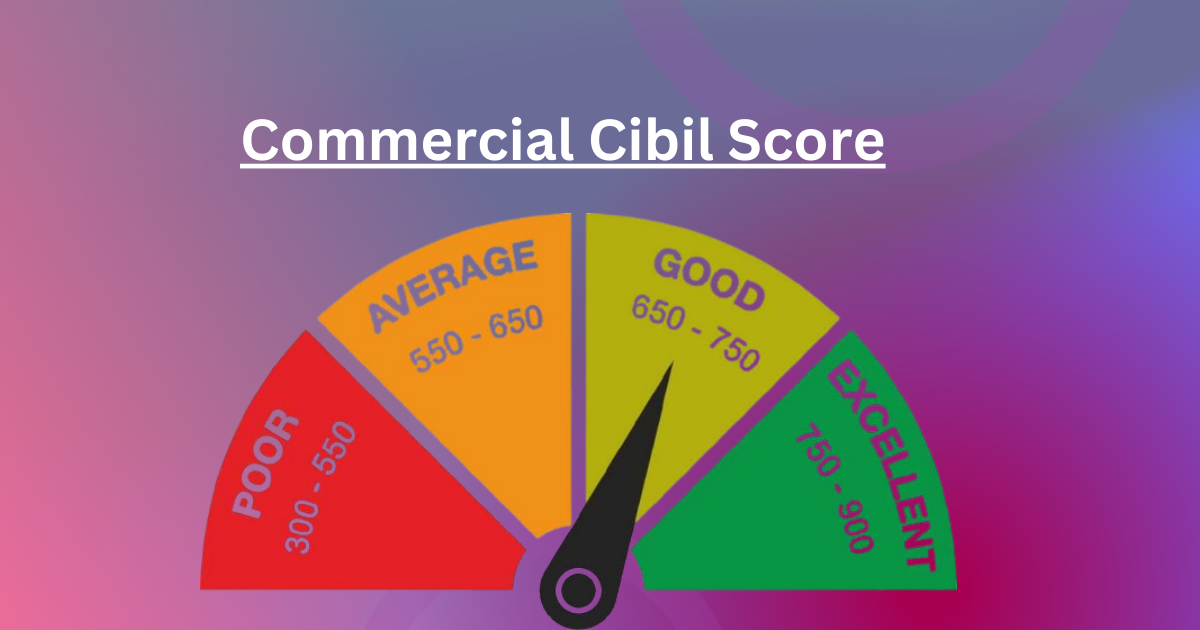

Before delving into the CIBIL login process, it is important to understand what CIBIL is and why it holds significant relevance. CIBIL is one of India’s premier credit information companies. It collects and maintains records of individuals’ and businesses’ credit-related information, received from banks and other financial institutions. The data is then used to create credit reports and credit scores that lenders use to assess the creditworthiness of borrowers. A good CIBIL score can open doors to favorable loan terms, while a poor score might hinder financial opportunities.

Creating Your CIBIL Account

Before you can access your credit information, you need to create a CIBIL account. This is the first step in the CIBIL login process.

1. Visit the Official CIBIL Website:

Begin by navigating to the official CIBIL website (www.cibil.com). The homepage provides various options related to credit information services for both individuals and commercial users.

2. Choose Your Plan:

CIBIL offers different subscription plans tailored to individual or commercial needs. If you are an individual, consider options that provide monthly or annual access to your credit report. For businesses, commercial CIBIL plans offer detailed insights into business credit health.

3. Sign Up for an Account:

On selecting the appropriate plan, you will be prompted to create an account. This involves filling in personal (or business) details, such as name, address, and identification information. For commercial CIBIL users, additional documents may be required.

4. Verify Your Identity:

To ensure security and privacy, CIBIL requires you to verify your identity. This can be done through a One-Time Password (OTP) sent to your registered mobile number or email.

CIBIL Login: Accessing Your Credit Information

Once your account is created, you can proceed to the CIBIL login process to access your credit information.

1. Navigate to the Login Page:

On CIBIL’s homepage, locate the login option for either individuals or commercial users, depending on your category.

2. Enter Your Credentials:

Input your registered email ID and the password you set during account creation. Double-check to avoid any errors that might delay access.

3. Dashboard Access:

After successfully logging in, you’ll reach your personalized dashboard. Here, you can view your credit score, detailed credit report, and financial history.

4. Understanding Your Credit Report:

Take time to comprehend the different sections of your credit report. For commercial CIBIL users, the report provides insights into the firm’s credit position, payment history, and other financial markers.

5. Download and Save:

It’s advisable to download and keep a copy of your credit report for future reference. This can be crucial when disputing any discrepancies or errors.

Addressing Common CIBIL Login Issues

It’s not uncommon to encounter issues during the CIBIL login process. Here are solutions to some frequent problems:

1. Forgot Password:

If you’ve forgotten your password, use the ‘Forgot Password’ option on the login page. Follow the prompts to reset your password using your registered email or mobile number.

2. Account Lockout:

Multiple failed attempts can lead to account lockout. In such cases, contact CIBIL’s customer support for assistance in unlocking your account.

3. Technical Glitches:

Ensure your browser is updated and compatible with the CIBIL website. Clearing your browser’s cache and cookies can also resolve minor technical issues.

4. Verification Issues:

If you are unable to verify your identity during login, recheck the accuracy of the details provided and opt for email verification if mobile OTP fails.

The Significance of Regular Access to Your Credit Information

Routine access to your credit information via CIBIL login is crucial for several reasons:

– Credit Monitoring:

Regular login allows for constant monitoring of your credit score, helping you track improvements or declines.

– Error Detection:

Early detection of errors in your report enables timely disputes, safeguarding your financial standing.

– Informed Financial Decisions:

With insights from your credit report, make prudent choices regarding loans, credit cards, and business financing.

Benefits of Commercial CIBIL for Businesses

For business entities, availing commercial CIBIL services provides distinct advantages:

– Enhanced Creditworthiness:

A business with a good CIBIL report is more likely to secure loans or favorable credit terms.

– Partnerships and Investments:

Positive credit information can attract investors and facilitate new partnerships.

– Risk Management:

Understanding the financial health of your business through commercial CIBIL prevents potential risks and aligns business strategies.

Conclusion

Navigating the CIBIL login process seamlessly is an invaluable skill, ensuring you have immediate access to critical credit information. Whether you’re an individual managing personal finances or a business optimizing credit health, access to real-time data empowers you to make informed decisions. This guide provides the foundation to understand and regularly monitor your credit standing effectively. Embrace the ease and clarity that comes with knowing your financial landscape, allowing CIBIL to be your trusted partner in maintaining a robust credit profile.